capital gains tax rate increase

The top marginal tax rate on long-term capital gains is 238 percent compared to a top marginal tax rate of 408 percent on wage income. Among the items mentioned in the plan is an increase in the highest tax rate on long-term capital gains and dividends to 25 percent from the current rate of 20 percent.

Selling Stock How Capital Gains Are Taxed The Motley Fool

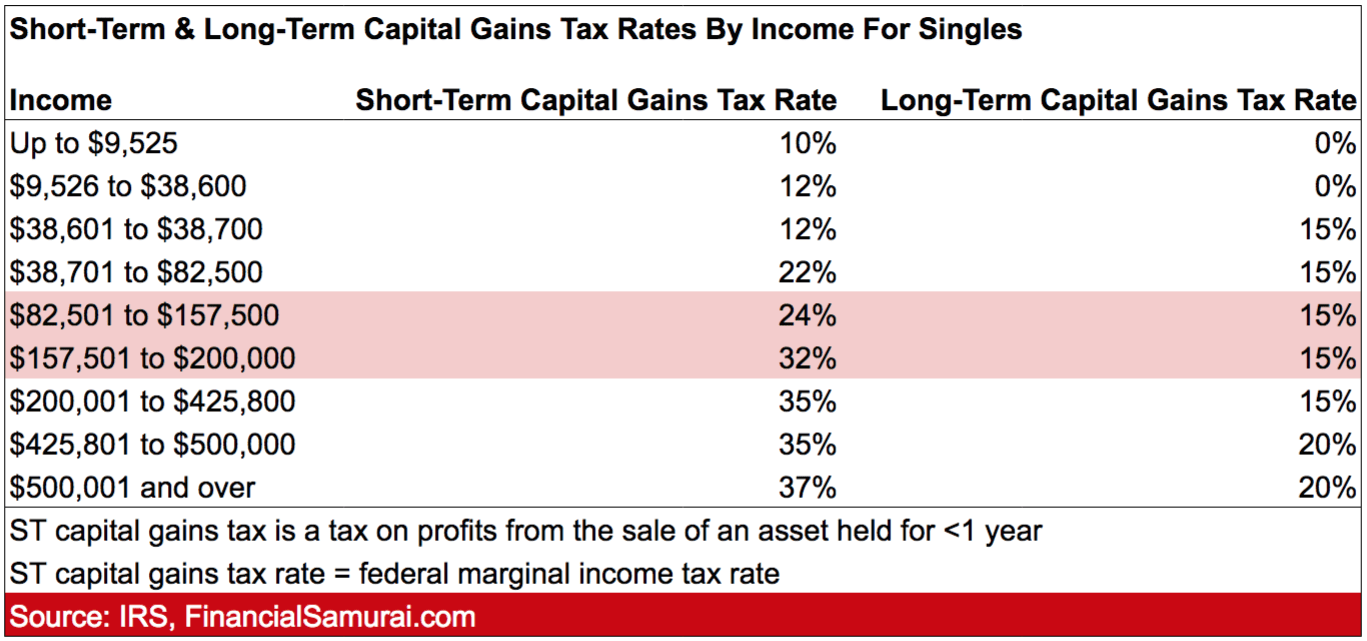

The rate jumps to 15 percent on capital gains if their income is 41676 to 459750.

. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession.

In 1978 Congress eliminated. Only Ireland has a higher rate. From 1954 to 1967 the maximum capital gains tax rate was 25.

Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized. Above that income level the rate climbs to 20 percent.

The most recent draft legislation contains a surtax on high income individuals. However married couples who earn between 83350 and 517200 will have a capital gains rate of 15. A 5 surtax will be applied to individuals estates and trusts with modified adjusted gross.

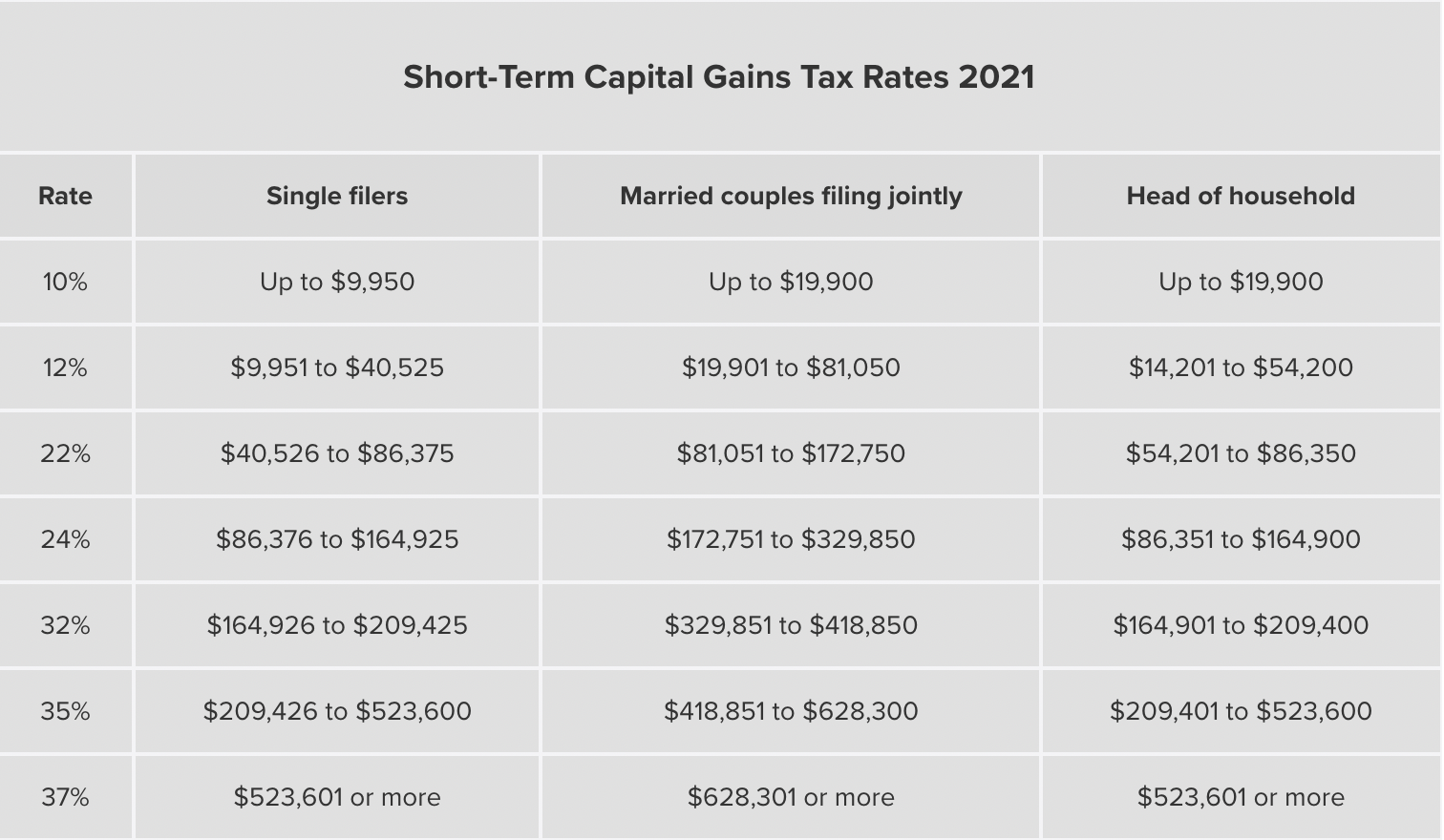

Could an increase to say 67 as it was from 1988-89 or 75 as it was from. SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable. 10 12 22 24 32 35 or 37.

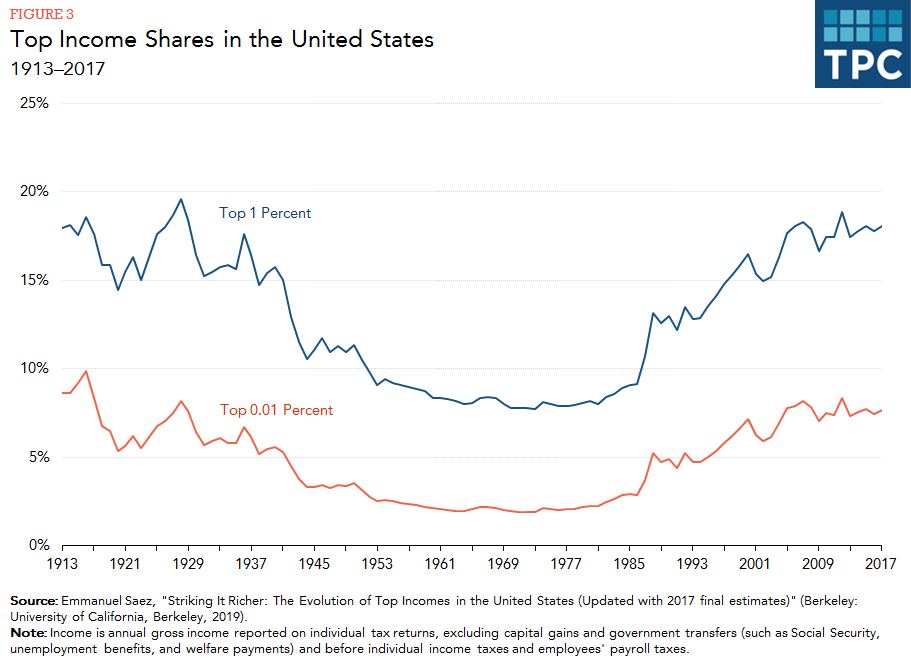

4 rows Understanding Capital Gains and the Biden Tax Plan. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Biden proposed raising the top capital.

For instance the top individual. The new rate would apply to gains realized after Sep. 7 rows There is currently a bill that if passed would increase the capital gains tax in Hawaii to.

Those with incomes above 517200 will find themselves getting hit. In addition those capital. 15 Tax Rate.

However after the 1986 capital. 4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and.

Currently the capital gains rate is 20 for. In 2022 it would kick in for single filers with taxable. 3 Second capital gains taxes on.

Decades ago the top statutory rate for capital gains climbed to 28 in 1987 up from 20. Capital gains tax rates on most assets held for a year or less correspond to ordinary income tax brackets. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by.

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49 between federal and state taxes.

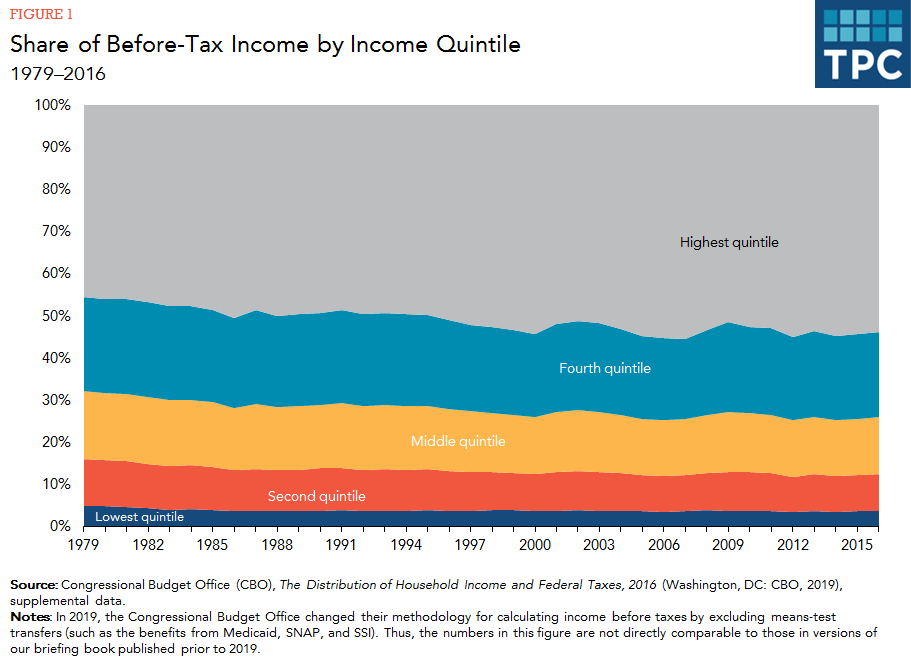

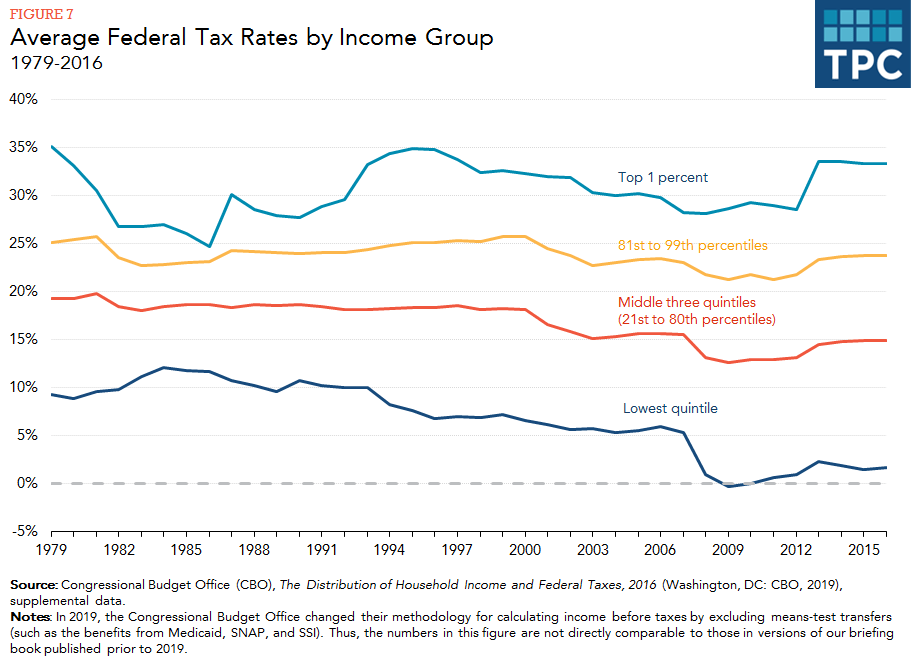

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Capital Gains Tax What Is It When Do You Pay It

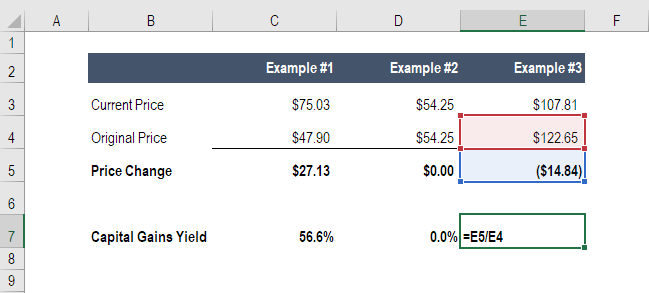

Capital Gains Yield Cgy Formula Calculation Example And Guide

Owning Gold And Precious Metals Doesn T Have To Be Taxing

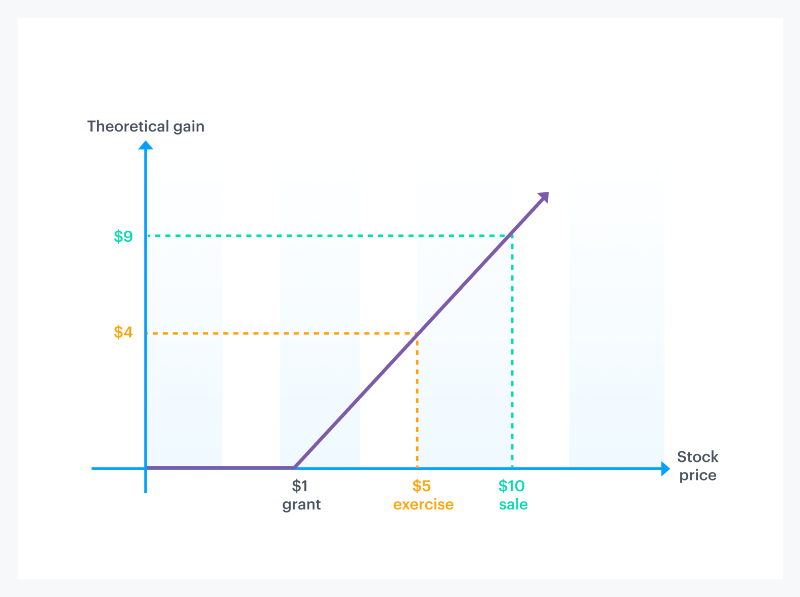

How Stock Options Are Taxed Carta

The Average Household Income In America Financial Samurai

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)